Did you just receive a high price for your green slip renewal? You don’t have to stay with the same insurer. Find out how to compare prices and change your green slip insurer. Read More

Did you just receive a high price for your green slip renewal? You don’t have to stay with the same insurer. Find out how to compare prices and change your green slip insurer. Read More

Are you a business owner who needs a green slip for your vehicle? Consider who owns it, primary use of your vehicle, how far you travel and GST. Our green slip calculator compares prices for business owners. Read More

When you buy a green slip, do you wonder where your money goes? Around two thirds of a green slip premium goes directly to people who make green slip claims. The rest goes to the insurers, the Fund Levy, GST and other expenses of the Compulsory Third Party green slip scheme. Read More

If you have an accident and it’s your fault, your green slip price could go up. If you also make a claim or incur demerit points, this also pushes up your green slip price. Remember, you pay less for safe driving, with no accidents or demerit points. Read More

Your top 3 costs are car loans, fuel and motor insurance. With a loan, you could spend $213 or 72% more every week than someone without a loan. Find out the costs of running a car in Sydney. Read More

Are you on your L plates and need a green slip? Are you on red P1 or green P2 plates and need a green slip? Green slips can be expensive for you or your parents. Find out the cost of a green slip for L and P platers and how to keep prices down. Read More

In NSW, you have to buy a green slip before you can register your vehicle. Vehicles more than 5 years old also need a pink slip each year. Unregistered vehicles may need a blue slip. Find out what they are and whether you need one. Read More

Did you know the way you drive is an important factor in your green slip price? Find out how to be what insurers consider to be be a ‘good’ driver. We reveal how much your driving record affects your green slip price. Read More

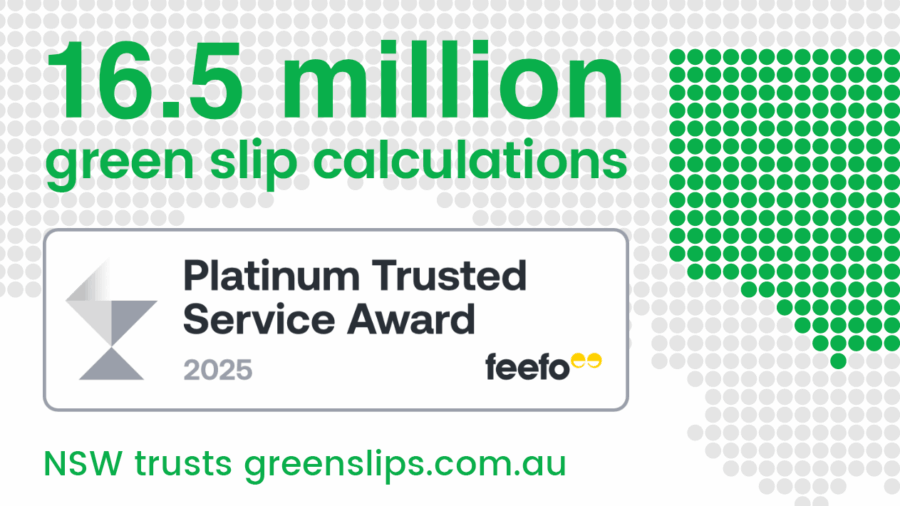

Do you use our green slip calculator every year? We analysed all our anonymous calculator visits during the year to 30 June 2025. Find out if you are a typical visitor. Read More

If the price of your green slip has gone up, it may be because of a change in your vehicle or circumstances. Insurers consider many factors to set the price of your green slip. Find out some possible reasons why yours has gone up. Read More

Do you have more questions about CTP green slips, insurers or the greenslips.com.au Calculator? Search our site using our new AI Search.