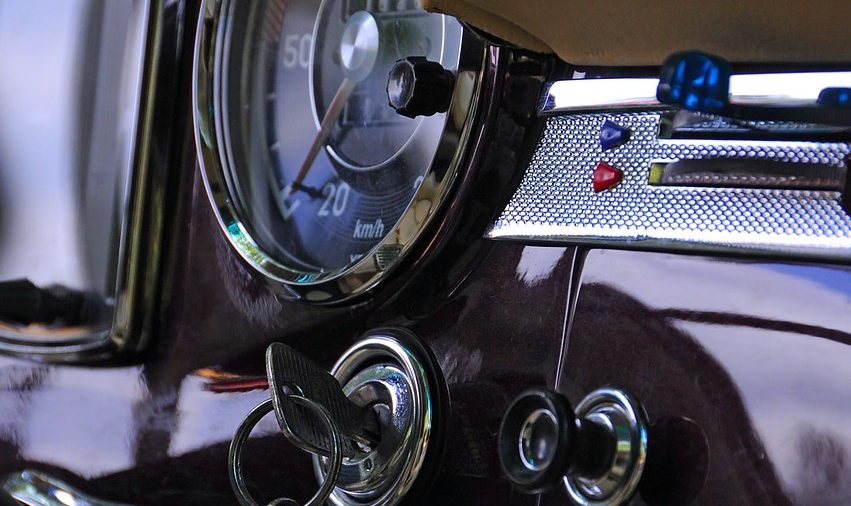

Electronics could make up 45-50% of the cost of a new car by 2030. Many new cars use advanced driver assistance systems, such as automatic emergency braking and adaptive cruise control. But do these extra really improve safety? Some features have proved to reduce insurance claims for BMWs in the US while others had no effect. Read More