Primary factors insurers use

Insurers set green slip prices and State Insurance Regulatory Authority (SIRA) regulates those prices. Insurers use different factors and apply different weightings to these factors to set the premiums they will charge.

Certain factors used by insurers affect green slip prices.

Primary factors used by insurers

| Owner and vehicle | Driving and claims record |

|

Geographic region |

Driving record: |

|

Type of vehicle |

|

|

Age of vehicle |

|

|

Distance travelled |

|

|

Vehicle performance |

Claims history: |

|

Age of vehicle owner |

|

|

Age and gender of youngest driver |

|

Five rating regions

SIRA designates 5 geographic (rating) regions and vehicle classifications.

There are 5 geographic regions:

- Sydney Metropolitan

- Outer Metropolitan

- Wollongong

- Newcastle/Central Coast

- Country.

Insurers are not allowed to differentiate prices on the basis of locality within a rating region.

Green slip prices vary

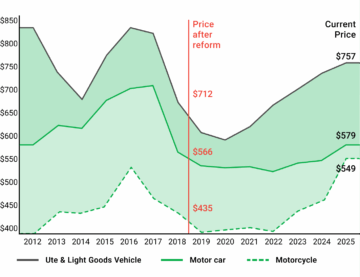

In the past 12 years, green slip prices have varied considerably. This makes it more important than ever to compare prices.

Average green slip prices at June 2012 to 2025

|

At June |

Motor car |

Ute/LGV |

Motorcycle |

|

2012 |

$575 |

$843 |

NA |

|

2013 |

$616 |

$764 |

$437 |

|

2014 |

$608 |

$724 |

$429 |

|

2015 |

$662 |

$793 |

$447 |

|

2016 |

$689 |

$841 |

$535 |

|

2017 |

$695 |

$833 |

$465 |

|

2018 |

$566 |

$712 |

$435 |

|

2019 |

$535 |

$661 |

$406 |

|

2020 |

$531 |

$651 |

$412 |

|

2021 |

$535 |

$675 |

$414 |

|

2022 |

$521 |

$705 |

$405 |

|

2023 |

$541 |

$736 |

$439 |

|

2024 |

$546 |

$735 |

$462 |

|

2025 |

$579 |

$757 |

$549 |

How SIRA regulates prices

Insurers must first submit proposed prices to SIRA, setting out proposed premiums and supporting information. Insurers must submit prices to SIRA at least once a year. They may also submit a non-compulsory filing if they wish to vary premiums at other times during the year.

SIRA may reject a filing if it considers the proposed premiums:

- will not fully fund the insurers liability

- are excessive, or

- do not conform with Premiums Determination Guidelines.*

* SIRA issues Premiums Determination Guidelines to regulate how green slip prices are set. SIRA also regulates distribution and marketing of green slips through the Market Practice Guidelines. Both are in the Motor Accident Guidelines 2017, available from SIRA.

As the regulator, SIRA must ensure the scheme is competitive and green slips are affordable:

- The scheme is competitive only if a sufficient number of insurers are motivated to participate.

- Insurers participate only if there is sufficient profit.

SIRA also operates a price comparison service, Green Slip Price Check.